Industrial real estate is emerging as a strong contender for investors looking to diversify their portfolios. With e-commerce growth and supply chain optimization driving demand, industrial properties offer a unique opportunity for profitable investments. In this blog post, we explore key factors that make industrial real estate a promising sector in 2024 and beyond.

The Rise of E-commerce and Its Impact

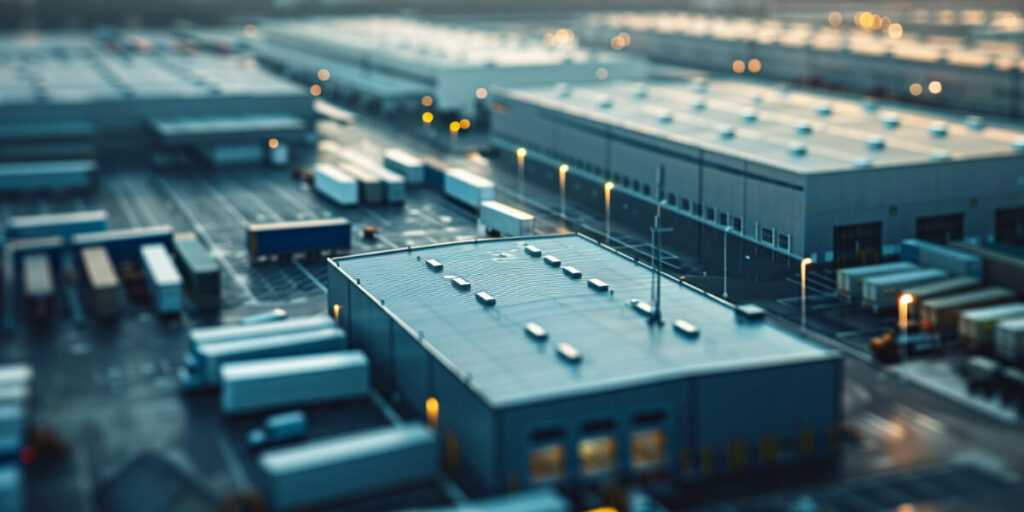

The e-commerce boom has transformed the industrial real estate landscape. With consumers increasingly shopping online, the need for warehousing and distribution centers has surged. Industrial properties that cater to logistics, last-mile delivery, and fulfillment centers are particularly in demand. Investors can capitalize on this trend by targeting properties strategically located near major transport hubs and urban centers.

Sustainability: A Growing Demand

Sustainability is becoming a critical factor in industrial real estate. Companies are seeking eco-friendly facilities that not only meet regulatory requirements but also align with corporate social responsibility goals. Properties with energy-efficient systems, green certifications, and sustainable building materials are highly attractive to tenants. Investing in sustainable industrial real estate can yield long-term benefits, including lower operating costs and higher tenant retention rates.

Flexibility and Adaptability

Industrial properties that offer flexibility are highly sought after. With the rapid pace of technological advancements, businesses require spaces that can adapt to changing needs, such as automation and robotics integration. Investors should look for properties with features like high ceilings, open floor plans, and ample loading docks, which can accommodate various types of tenants and industries.

Location, Location, Location

As with all real estate, location is crucial in industrial investments. Properties located near major highways, ports, and airports are particularly valuable, as they provide easy access to transportation networks. Additionally, areas with strong economic growth and business-friendly environments are ideal for industrial real estate investments.

Conclusion

Industrial real estate offers a promising avenue for profitable investments in 2024. By focusing on properties that cater to the booming e-commerce sector, prioritize sustainability, and offer flexibility, investors can position themselves for success in this dynamic market. Stay informed and explore the potential of industrial real estate with Work with Bibi.

For more insights and investment opportunities, visit our blog or contact us today!

Subscribe to the newsletter

Don’t Miss Any of Our Blog Posts, Subscribe to Our Weekly Newsletter Today!

Recent posts

What to Expect When Working with a CRE Agent: Your Guide to a Successful CRE Journey

Navigating the commercial real estate (CRE) market is a complex process that demands more than just basic knowledge. It requires

How to Find a Good Commercial Real Estate Broker: Your Guide to Navigating CRE

Navigating the complex landscape of commercial real estate (CRE) requires more than just a basic understanding of the market. Whether

Benefits of Adaptive Reuse for Restaurant Spaces

Adaptive reuse, the process of repurposing existing buildings for new uses, has become an increasingly popular strategy in the restaurant